Money is a popular topic in the IELTS Speaking test. Examiners may ask you about how you manage your finances, whether you prefer saving or spending, your attitude toward shopping, how important money is in your life, or whether money can bring happiness. In this guide, you’ll learn useful IELTS vocabulary for money with clear definitions, followed by IELTS Speaking Part 1, Part 2, and Part 3 questions with sample answers.

IELTS Vocabulary for Money

Here is some useful IELTS vocabulary for talking about money with clear definitions. These words and phrases will help you give better answers in the IELTS Speaking test.

- Spendthrift – someone who spends money carelessly.

- Big spender – someone who often spends a lot of money.

- Penny-pincher – someone who hates spending money.

- Cheapskate – someone who spends as little as possible.

- Underprivileged – having little money and fewer advantages than others.

- Bargain hunter – someone who looks for the lowest prices.

- On the breadline – to be extremely poor or near poverty.

- Well-to-do – having a lot of money or wealth.

- Well-off – financially comfortable or wealthy.

- Income – money received from work or investments.

- Disposable income – money left after paying all necessary bills.

- Financial stability – having enough money to cover all expenses.

- Cost of living – the amount of money needed for basic expenses.

- Living wage – a salary that covers basic living costs.

- Budget – a plan for how money will be spent or saved.

- Investment – money used to make more money.

- Interest rate – the percentage charged on borrowed money.

- Exchange rate – the value of one currency compared to another.

- Piggy bank – a small container used to save coins, often for children.

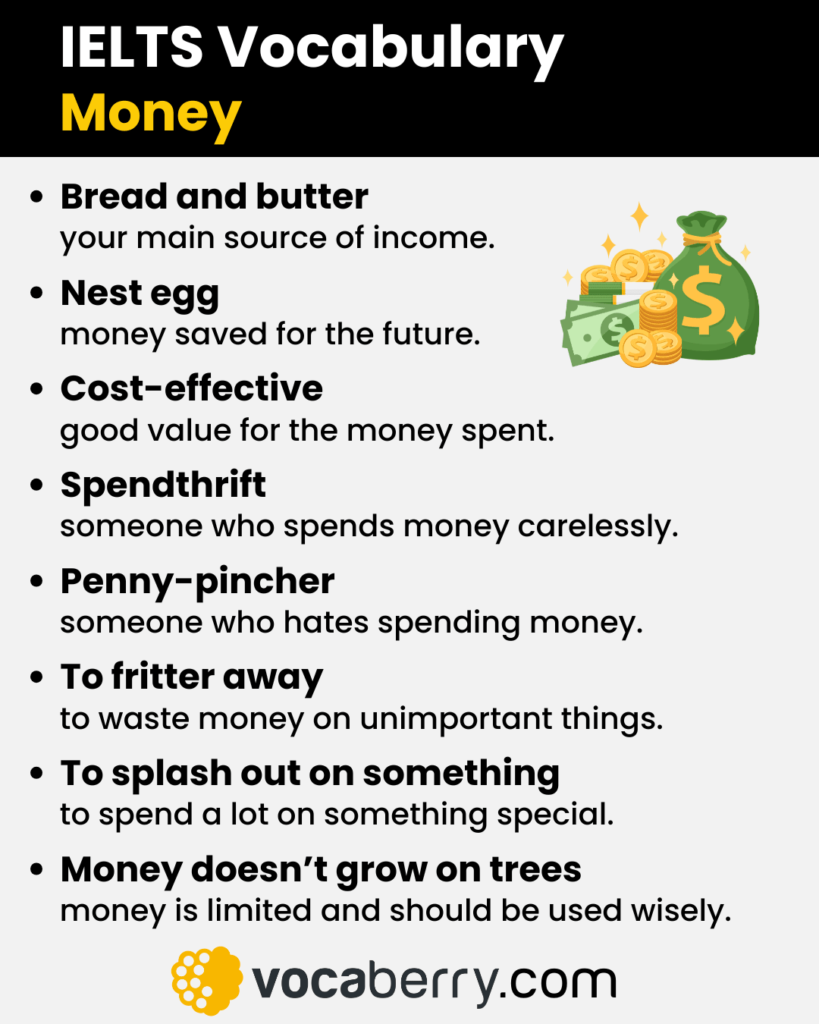

- Cost-effective – giving good value for the money spent.

- Nest egg – money saved over time for future use.

- Easy money – money earned with little effort.

- Bread and butter – a person’s main source of income.

- Strapped for cash – lacking money at the moment.

- Return on investment (ROI) – the profit earned from an investment.

- Financial burden – a heavy cost or debt someone has to carry.

- Income disparity – the gap between high and low earners.

- Emergency fund – money saved for unexpected expenses.

- Credit history – record of past borrowing and repayments.

- Solid credit score – a strong rating for repaying borrowed money on time.

- Passive income – money earned without actively working, like from investments.

- Wealth distribution – how money is spread across a society or population.

- Money pit – something that continually requires a lot of money.

- Wealth gap – the difference in income between rich and poor.

- Economic inequality – unfair difference in wealth or income.

- Economic hardship – a situation where people struggle financially.

- Financial literacy – understanding how money works and how to manage it.

- Financial independence – being able to support oneself without help from others.

- Charitable organization – a group that helps others through donations.

- Rainy day fund – money saved for unexpected expenses.

- Impulse buying – spending money on things you didn’t plan to buy.

- To make ends meet – to manage to live within your income.

- To live paycheck to paycheck – to use all your income before the next payment.

- To be broke – to have no money left.

- To be in debt – to owe money to someone or a bank.

- To go bankrupt – to lose all money and be unable to pay debts.

- To manage finances – to control how you spend and save money.

- To live on a tight budget – to manage with very little money.

- To cut down on expenses – to reduce how much you spend.

- To save up for something – to save money for a specific purpose.

- To transfer money – to send money from one account to another.

- To invest in something – to put money into something to make a profit.

- To take out a loan – to borrow money from a bank.

- To pay off debt – to finish repaying borrowed money.

- To tighten your belt – to spend less due to financial limits.

- To splash out on something – to spend a lot on something special.

- To be thrifty – someone who spends money wisely.

- To overspend – to spend more than you can afford.

- To live beyond your means – to spend more than you earn.

- To waste money – to spend money carelessly.

- To raise funds – to collect money for a cause or event.

- To donate money – to give money to charity or people in need.

- To live frugally – to live simply and avoid unnecessary spending.

- To budget wisely – to plan your spending carefully.

- To make a fortune – to earn a lot of money quickly.

- To build wealth – to gradually increase your money or assets.

- To generate income – to create a source of money.

- To keep track of spending – to monitor where your money goes.

- To be on a shoestring budget – to live or do something with very little money.

- To be ripped off – to be charged too much for something.

- To put some money aside for a rainy day – to save money for future problems.

- To fritter away – to waste money on small, unimportant things.

- To save for retirement – to put money away for when you stop working.

- To cost an arm and a leg – to be extremely expensive.

- To bring home the bacon – to earn money to support a household.

- To set up a budget – to create a plan for spending and saving money.

- To shop around – to compare prices before buying.

- To be hard up – to have very little money.

- To live from hand to mouth – to have just enough money to survive.

- Consumer-driven culture – a society strongly influenced by buying and spending.

- Materialistic society – a culture that values money and possessions.

- Born with a silver spoon in your mouth – to be born into a rich family.

- A penny saved is a penny earned – saving money is just as valuable as earning it.

- Money is burning a hole in his pocket – he wants to spend money quickly.

- Money doesn’t grow on trees – money is limited and must be spent wisely

IELTS Speaking: Money Questions & Answers

In this section, you’ll find IELTS Speaking Part 1, Part 2, and Part 3 questions on money with sample answers. These examples show how the money-related vocabulary can be used in your responses during the test.

IELTS Speaking Part 1 – Money

Are you good at managing your money?

I try my best to be. I usually set up a budget at the start of the month and keep track of my spending so I don’t end up strapped for cash. I used to be careless, but now I avoid impulse buying and focus more on long-term goals like building a nest egg.

What kind of things do you usually save money for?

I mainly save to put some money aside for a rainy day, just in case of emergencies. I also save to make ends meet during unpredictable months, and in the future, I want to save for retirement and gain financial independence.

Do you ever regret spending money on something?

Yes, a few times I’ve been ripped off when shopping online or made some poor choices during sales. I bought things I didn’t need, which weren’t cost-effective at all. It was a learning experience, and now I always shop around before buying anything.

Do you think it’s better to save money or spend it?

Personally, I think saving is more important. A penny saved is a penny earned, as they say. While spending can be fun, having financial stability brings peace of mind. I prefer being careful with my money rather than becoming a spendthrift.

Do you prefer buying expensive things or cheaper alternatives?

I usually go for things that are cost-effective. I’m a bit of a bargain hunter, so I compare prices before buying. I don’t mind paying more for quality, but I avoid spending an arm and a leg on trendy stuff just to fit in.

What is your main source of income right now?

At the moment, my part-time job is my bread and butter, but I’m also trying to build some passive income by investing a bit. It’s not much, but I believe it’s a good way to build wealth slowly and become more well-off in the future.

IELTS Speaking Part 2 – Money Cue Card

Describe a time when you saved money for something.

You should say:

- what you saved money for

- how long it took you to save

- how you saved the money

- and explain how you felt after buying it.

Sample Answer:

About a year and a half ago, I decided to save up for something quite important, a new smartphone. My old one was several years old, the battery barely lasted a few hours, and the performance was getting worse. But instead of rushing to buy one using a credit card or taking out a loan, I challenged myself to pay for it entirely with my own savings.

At the time, I was a student and kind of strapped for cash, so I really had to think smart. I created a simple budget using a mobile app to keep track of my spending, and I cut out unnecessary expenses like daily coffee shop visits and eating out. I stopped buying luxury items and made an effort to live on a tight budget. Honestly, I was almost living paycheck to paycheck, so saving anything at all felt like a win.

Instead of keeping my savings in my main account, I opened a savings account and started putting some money aside for a rainy day, just in case. I also took on a part-time tutoring job, which became my bread and butter for several months. That small income helped me build a modest nest egg over time. I avoided impulse buying, shopped around for better deals, and always asked myself whether a purchase was really cost-effective.

After five or six months, I had enough to buy the phone I wanted without going into debt, and it felt amazing. I wasn’t a big spender anymore, quite the opposite. I had become more aware of my financial habits and how easy it is to fritter away money on things that don’t matter. That experience gave me more financial literacy, and now I continue to save regularly, not just for things I want, but also to feel a sense of financial stability.

Looking back, I think learning how to manage my finances early on gave me more confidence and helped me work toward financial independence. It also reminded me that money doesn’t grow on trees, and being a little bit of a penny-pincher sometimes isn’t a bad thing, especially when you have a goal in mind.

IELTS Speaking Part 3 – Money Discussion

IELTS Speaking Part 3 questions about money often ask you to compare spending and saving habits, discuss the value of money in modern life, and give opinions on topics like budgeting, materialism, or whether money leads to happiness.

Why do you think some people find it hard to save money?

In my view, the biggest reason is the increasing cost of living, which makes it challenging for people to make ends meet, let alone save. Many individuals are living paycheck to paycheck, so even the idea of setting aside a small amount seems unrealistic. Additionally, the lack of financial literacy often leads to poor money habits, such as impulse buying or failing to set up a budget. People may also fritter away money on things they don’t truly need, simply because they don’t track where it goes. Without a clear goal or the discipline to put money aside for a rainy day, saving becomes more of a wish than a habit. Therefore, it’s not just about income, but also about mindset and education.

Do you think it’s important to teach children about money?

Absolutely. Instilling good financial habits early on can have a long-term impact. Many children grow up with the impression that money grows on trees, especially if they’ve never had to manage it themselves. By introducing them to tools like a piggy bank, or even helping them understand the basics of a budget, they begin to see the value of saving. Over time, they can learn how to manage their finances, avoid wasting money, and eventually build toward financial independence. In today’s consumer-driven culture, I believe teaching these skills is just as important as academics. It prepares them to make smarter financial choices as adults.

Do you think poor people are less financially responsible than rich people?

Not necessarily. In fact, people who are strapped for cash often manage their money with extreme care, because they don’t have the luxury of making financial mistakes. They may live on a shoestring budget, cut down on expenses, and plan every purchase to make ends meet. On the other hand, some well-off individuals, despite earning more, may fall into impulse buying or overspending habits. Financial responsibility isn’t about how much you earn but how wisely you manage your money. Even someone on the breadline can be more disciplined than a big spender who doesn’t track their expenses.

Should governments do more to reduce the gap between rich and poor?

Definitely. The growing wealth gap and income disparity can lead to long-term social and economic problems. When the underprivileged struggle to access basic services or live on a living wage, it becomes hard for them to break the cycle of poverty. Governments can step in by improving access to education, encouraging financial literacy, and supporting programs that create bread and butter opportunities. Additionally, policies around wealth distribution and fair taxation can help bridge the divide. It’s not just about charity but creating a system where more people can achieve financial stability and contribute meaningfully to the economy.

More IELTS Vocabulary Topics

If you found this lesson useful, explore other IELTS Speaking topics to expand your vocabulary and practice with sample answers:

- IELTS Vocabulary: Accommodation

- IELTS Vocabulary: Advertisement

- IELTS Vocabulary: Animals

- IELTS Vocabulary: Art

- IELTS Vocabulary: Artificial Intelligence

- IELTS Vocabulary: Books

- IELTS Vocabulary: Childhood

- IELTS Vocabulary: Crime and Punishment

- IELTS Vocabulary: Culture and Traditions

- IELTS Vocabulary: Daily Routine

- IELTS Vocabulary: Education

- IELTS Vocabulary: Environment

- IELTS Vocabulary: Family

- IELTS Vocabulary: Fashion and Clothes

- IELTS Vocabulary: Films

- IELTS Vocabulary: Food & Diet

- IELTS Vocabulary: Friends

- IELTS Vocabulary: Gifts

- IELTS Vocabulary: Health

- IELTS Vocabulary: Hobbies

- IELTS Vocabulary: Hometown

- IELTS Vocabulary: Museums

- IELTS Vocabulary: Music

- IELTS Vocabulary: Plants

- IELTS Vocabulary: Shopping

- IELTS Vocabulary: Social Media

- IELTS Vocabulary: Sports

- IELTS Vocabulary: Technology

- IELTS Vocabulary: Transport

- IELTS Vocabulary: Travel

- IELTS Vocabulary: Weather

- IELTS Vocabulary: Work & Jobs